Latest research from Capify finds that green investments are slipping down the priority list for UK SMEs. But when the economy recovers, those companies with sustainable credentials will be well-placed to accelerate their growth.

- Environmental Society, Governance (ESG) will shape business dynamics over the next decade

- Fewer SMEs are investing in green and sustainable initiatives

- Taking a long-term view may accelerate growth when economic recovery comes

- Access to finance for ESG initiatives is problematic for SMEs

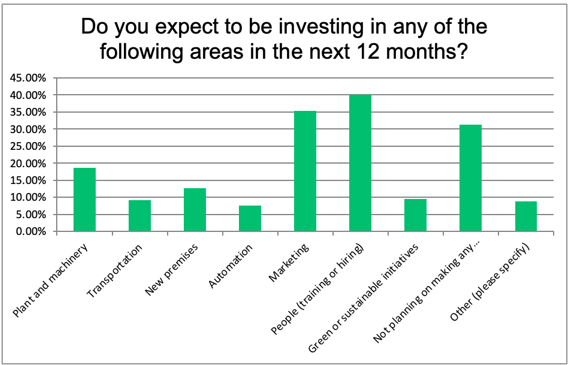

According to Capify’s 2022 Q2 Business Confidence Survey, the number of SME intending to invest in green and sustainable initiatives has dropped significantly. When asked about areas in which they intend to invest over the coming year, only 10% of firms cited green or sustainable initiatives – a drop of 11% from the previous quarter.

The latest British Chambers of Commerce outlook suggests that the UK economy will slide into recession in Q4 of this year and not recover until 2024. Across this period, UK SME business investments are expected to grow by 4% in 2022 but shrink by 0.4% in 2023 before rebounding to 1.1% in 2024.

Understandably, against a backdrop of falling consumer confidence and double-digit inflation, businesses are having to carefully consider which investment areas they will need to prioritise. For many business owners, short-term survival will be the principal objective and focus for the coming months. But for those who are able to invest in the downturn, the rewards could be great.

Source: Capify Q2 2022 Business Confidence Survey

Taking a long-term view

When the inevitable recovery comes, customers, investors and staff will still be focused on selecting businesses with demonstrable Environmental, Social and Governance (ESG) credentials. ESG will be the most important theme shaping business this decade. The current wave of sustainability consciousness is unprecedented and is being driven in both directions through the value chain: bottom-up from consumers, and top-down from investors and regulators. With the United Nations Climate Change Conference – COP27 – scheduled to take place in November 2022, we will likely see renewed endeavours from global governments to implement lasting change.

Accordingly, all businesses irrespective of size, will benefit from taking a long-term view toward ESG. As the recession abates, employees, customers and investors will want to see businesses active in preserving the planet for future generations. For larger companies, failure to pursue net zero and address the climate crisis in the near future is no longer an option. But for smaller businesses, ignoring the sustainability agenda will have a detrimental impact on talent acquisition, the ability to access investments, and winning and retaining customers.

Small changes, big impact

Implementing ESG practices and activities in an SME should be considered a two-stage process. The first stage is to measure and understand how your business impacts ESG areas such as carbon emissions and set goals to improve from this baseline. The second stage is to implement an ESG programme that changes your operations to improve your baseline metrics.

Each programme will be unique to each business, but is likely to include some of the following areas:

- Reducing energy usage through behavioural change or investment in energy-efficient equipment

- Reducing waste in your business operations

- Using sustainable suppliers and materials in your production process

- Measuring and reducing your carbon emissions

- Assessing your business operations against extreme weather

- Supporting diversity and inclusion in your workforce

- Securing industry-appropriate external accreditation through organisations like B Corp, Fair Trade, Gold Standard or EU Ecolabel.

Investing in tomorrow

Many of these initiatives require no capital investment, but significant changes in production processes and machinery may require a financial commitment. Unfortunately, for many firms, securing the necessary finance has historically proven a barrier to pursuing sustainability-focused improvements. According to the OECD’s report ‘Financing SMEs for sustainability’, 27% of European SMEs identify a lack of financial resources as the main reason preventing them from becoming more sustainable. The report recognises that SMEs often struggle to secure finance from traditional sources, especially when that money is required for ESG initiatives. “In addition to the longstanding challenges that SMEs face in accessing finance” the report says, “SMEs seeking to undertake sustainable and green actions face additional barriers to fund these activities.”

As bank credit facilities continue to tighten for SMEs, alternative financing methods such as an unsecured business loan, could be much more suited to funding your ESG investments. They don’t require owners to have large sums of money in the bank and are much more accessible to UK small businesses.

There is an element of counter-intuition regarding the idea of investing as business toils and the economy suffers. However, as our article on marketing through a downturn [insert ref link] highlights, there can be many benefits for those firms who pursue this path.

Capify offer a range of business loans to help support your business through high and low periods. Check to see if you’re eligible for a Capify business loan with their online eligibility checker.