SMEs are turning to crowdfunding to fuel growth out of the pandemic, according to new research.

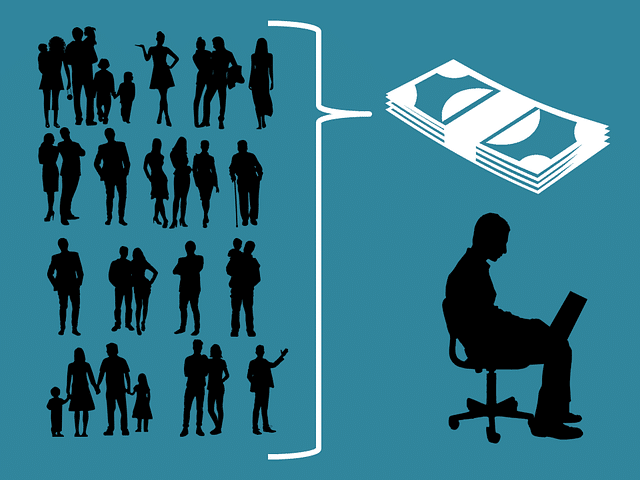

It suggests that a third of them are more likely to choose non-traditional ways of accessing capital such as crowdfunding or offering investment opportunities to employees than they are to seek debt finance, initiate a management buy-out, or seek venture capital or private equity investment.

All but one of the 250 C-suite executives and business owners polled by the law firm Moore Barlow said they intend to access some form of external investment in the next 12 months, with investing in innovation to develop new products and services and margin growth through improving pricing being the two most commonly cited primary growth strategies.

At the other end of the scale, buy-and-build and driving UK expansion were the least popular strategies for delivering growth.

Jeremy Over, partner in the corporate team at Moore Barlow, said: “SMEs are still ambitious despite the negative impact of the pandemic on many. The shift away from traditional forms of investment is for a number of reasons – firms want to be agile and are concerned about the bureaucracy involved with borrowing from the bank, or fear a tougher negotiation and loss of independence when taking venture capital or private equity backing.

“While crowdfunding does offer an antidote to some of these concerns, I would urge business leaders to take a step back, consult their advisors, and really think about whether this is the right option for them.

The real positive I take from our research is that businesses are looking to put their money where it matters

“The established mechanisms for accessing funding have stood the test of time for a reason and, even if they are sometimes harder to put in place, normally offer a better-structured and more resilient long-term option than faster ways of accessing capital.”

Less than a third of the business leaders questioned plan to invest in their business across the next 12 months order to drive future growth. Of those businesses, investment in people to upskill the workforce (32 per cent), improving employee benefits (29 per cent), driving graduate recruitment (28 per cent) and rethinking (29 per cent) or expanding (29 per cent) office space were the clear spending priorities.

Over added: “The real positive I take from our research is that businesses are looking to put their money where it matters – their offering to customers and their people. As they tackle the strong economic headwinds lying ahead, it’s vital for SMEs to have the right legal and financial structures in place to protect these important assets.”