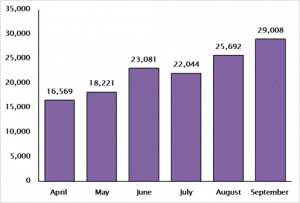

More new businesses were created in September than at any time in the previous 13 years, according to private equity analysts.

That month saw 29,008 new businesses registered in the UK, the highest number since October 2007 and the third-highest month since HMRC began keeping records in the late 1980s.

What’s more, new business creation increased month-on-month throughout the first Lockdown period.

Private equity firm Growthdeck says many people decided to start their own businesses during the Covid period, seeing lockdowns as an opportunity to work on their own ventures that they may have put off previously.

- 29,008 new businesses registered in September 2020

- That was the highest number since 2007

- New business creation bounced back quickly after first lockdown dip

Gary Robins, Head of Business Development, said: “British entrepreneurial spirit has been undeterred, despite the challenges presented by Coronavirus.”

“Despite 2020 being a difficult year, people have remained optimistic about starting businesses even in a challenging economy.”

Research earlier this year by Growthdeck found that the e-commerce sector in particular boomed due to the Covid-19 pandemic.

An average of 4,613 online retail businesses were set up per month during the peak months of April, May and June 2020, up 66 per cent from 2,783 on average per month in the previous year.

Growthdeck says that the sudden surge in new business creation is a reminder that the Government should do everything it can to ensure these businesses have access to the investment they need to scale up.

It says the Enterprise Investment Scheme (EIS), the Government’s flagship tax-advantaged investment scheme for growth businesses, should be protected from any tax increases introduced in the coming months.

“While support for established businesses has been rightly welcomed during the Covid-19 period, the government should be maintaining and potentially widening schemes that support start-ups and growth businesses.”

“The Enterprise Investment Scheme (EIS) is a crucial initiative that gets vital equity investment to SMEs and accelerates business growth. If the government does raise taxes, for example on capital gains, EIS should retain it’s tax advantages to encourage investment into early-stage businesses.”

More on Growthdeck here