Rock Level’s project is currently developing a radio frequency (RF) tag to track bees in flight. Zoya Malik, Managing Editor SME spoke to Neil Swindlehurst, Chief Creative Officer at Rock Level and Tom Heslin, Senior Sector Specialist, ForrestBrown who explained the project’s raison d’être and how the R&D tax credit claim saved the project

Zoya: What is the entrepreneurial story behind Rock Level?

Neil: My business partner and I set up Rock Level in 2009, having worked together at a number of other companies. We started Rock Level as we wanted to branch out on our own to focus on developing bespoke and innovative software-related projects, and we also wanted to develop a multi-media platform for companies. We’re a small team based in Chippenham, Wiltshire, and are particularly focused on driving innovation by creating products that don’t yet exist across a range of sectors, from healthcare through to broadcast.

Zoya: What interested you in developing this RF project and what’s its aim?

Neil: Rock Level has been a hive of activity this year after having announced we are developing a new RF tag to track bees in flight, in an effort to combat their declining numbers in the UK. Research from the Centre for Ecology and Hydrology has revealed that one-third of 300 native UK bee and hoverfly species are dying out – potentially spelling disaster for crops. Further research has shown that the number of managed honeybee colonies in the UK has fallen by 53% between 1985 and 2005.

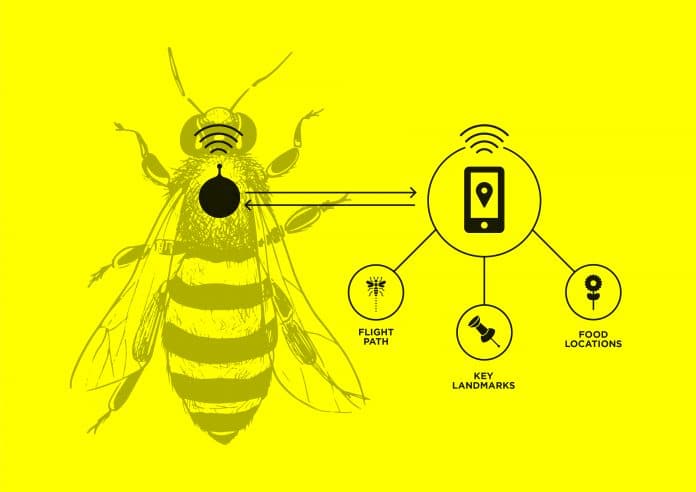

The project aims to gather data to address this declining number of bees, by understanding the problem and to find a solution. It seeks to drive further innovation within the sector by creating one of the world’s smallest RF trackers that is installed on the bees, similar to a miniature backpack. We took on this project on a pro bono basis following a chance meeting with a beekeeper in 2015. We realised we could use our software expertise to help overcome the difficulty of tracking bees in flight.

Zoya: What have been challenges in the project journey?

Neil: As stated, we initially started looking at solutions to help the plight of bees in 2015. Many other companies had attempted to create suitable tracking equipment, but current options simply kept count of bees’ numbers entering and leaving a hive, rather than tracking their flight pattern. However, our proposed solution was riddled with technological uncertainties that took up time and money. With limited project funding, Rock Level needed a cash boost to carry out the pioneering project. We turned to ForrestBrown, a specialist R&D tax credit consultancy for guidance in making an R&D tax credit claim to help fund it. The project would have discontinued if the R&D tax credit claim had not been secured.

Zoya: What was compelling about Rock Level’s market differentiation and criteria for successfully making an R&D tax claim?

Tom: R&D tax credit claims are there to help innovative businesses grow. Rock Level’s case is a good example of the transformative effect R&D tax credits can have on software businesses. They give businesses that bit more freedom to take risks to invest in something interesting and exciting. Businesses can access money that they wouldn’t normally have, whether that’s a reduction in tax and/or receiving a Corporation Tax credit. To qualify, projects don’t necessarily have to be commercial and you may not always pull off what you set out to, but the government appreciates the importance of companies being entrepreneurial to drive innovation – and that’s all about trying new ways of doing things.

The team at Rock Level had previous experience of completing an R&D tax credit claim themselves, but it had been a tricky and stressful process. Our organisation, ForrestBrown, was recommended by Rock Level’s accountant to facilitate the R&D tax credit claim, and we have since offered expert advice on how to identify qualifying work.

We produced a clear and concise application in just a three-week turnaround time to ensure the project could continue. As a result, Rock Level benefitted from a cash payment, which it reinvested back into the project. The money has enabled the company to continue its work successfully to secure tracking bees in the future.

Zoya: What’s the project roll-out?

Neil: Without this funding, we would have been unable to continue with this hugely important project and thankfully the project is still ongoing. Both the hardware and software require further testing and development to accurately monitor the bees’ complex movements. We aim to hold further trials this coming summer, with the ultimate aim of providing data to help scientists find a solution to reverse the decline of bees.

Zoya: What are the lessons for other entrepreneurs?

Tom: Entrepreneurs should think about R&D tax credits as an established source of funding that reduces the possible risks of attempting something new. They may be able to reap the rewards when it comes to making an R&D tax credit claim. We’d therefore actively encourage companies with a new project idea to consult with an R&D tax credit specialist from the start who can investigate if there might be a way to tap into new and ongoing funding for the venture. Some people might think that being grant-funded restricts them from using R&D tax incentives to grow their business, but in fact the opposite is true: if you’re grant funded you should without exception consider R&D tax credits as a source of funding.