By Jeremy Thomson-Cook, Chief Economist, WorldFirst

Confidence is a funny old thing. Everybody knows when the chairman of a football club says the manager has the “full confidence of the board”, someone else will soon be shouting instructions to the team from the touchline. However, the opposite seems to be true of British SMEs’ confidence in their potential for international growth despite the current climate of increased macroeconomic and political uncertainty.

Confidence is a funny old thing. Everybody knows when the chairman of a football club says the manager has the “full confidence of the board”, someone else will soon be shouting instructions to the team from the touchline. However, the opposite seems to be true of British SMEs’ confidence in their potential for international growth despite the current climate of increased macroeconomic and political uncertainty.

Over the course of the summer Britain has seen both business and consumer confidence slip to multi-month lows, with some of this weakness a result of domestic factors such as Brexit, potential interest rate hikes, and weak real wage growth. External factors have also played a role in the demise of SME sentiment with noises from the Trump administration not doing much to quell concerns in the short term.

However, in spite of all of this, the latest Global Trade Barometer from WorldFirst reveals that small businesses in the UK actually saw overseas trade rise for the first time in a year over the last quarter. The survey of more than 1,000 small and medium sized businesses also highlighted an increased level of confidence despite the existential threat that a no-deal Brexit outcome poses to international trade.

Business is booming

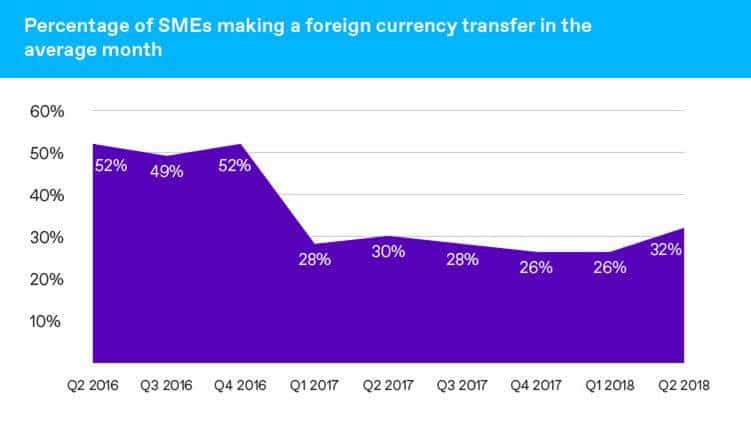

On average, UK SMEs made overseas transfers of £47,000 as small businesses engaged in approximately £84 billion worth of global trade over the quarter. This represents almost a 25% increase in average transfer values (£38,000) compared to the same period in 2016. What’s more, over the last quarter nearly a third (32%) of businesses made at least one foreign transaction a month, up 6% on Q1 2018.

On average, UK SMEs made overseas transfers of £47,000 as small businesses engaged in approximately £84 billion worth of global trade over the quarter. This represents almost a 25% increase in average transfer values (£38,000) compared to the same period in 2016. What’s more, over the last quarter nearly a third (32%) of businesses made at least one foreign transaction a month, up 6% on Q1 2018.

There is a caveat to this of course, in so much that while the average value of transactions has risen by 25%, the value of sterling itself is still down by around 10% since the referendum meaning businesses are essentially having to pay more for goods from abroad.

UK SMEs look to the continent

Having said this, an increasing number of SMEs are confident in their international prospects for the future, with a strong focus on Europe in particular. Our research found that 29% of businesses expect overseas revenue growth in the next quarter, with 27% looking to export to a new country in the coming months – a 3% increase from Q1 2018.

Many SMEs foresee continued success in Europe with 18% looking to enter Western Europe for the first time in the next three months, 11% being focused on Central Europe and one in ten considering trade in Eastern Europe.

Political jitters remain

Nonetheless, despite current levels of confidence, it will be interesting to see how this data develops as the UK inches closer to the Brexit door on 29 March 2019.

Nonetheless, despite current levels of confidence, it will be interesting to see how this data develops as the UK inches closer to the Brexit door on 29 March 2019.

In the first quarter of the year the Global Trade Barometer found that 44% of businesses disagreed with the following statement; “I am worried about the UK leaving the European Union and the impact it could have on the region(s) my business operates in”. However, our latest survey found that this figure had fallen to 28% in Q2, with 49% of businesses now agreeing with the statement.

However, the EU is not the only important trading partner for UK businesses with political developments further afield also having the potential to negatively impact SMEs at home.

Donald Trump’s proposed plan for trade tariffs, for example, will certainly impact the 1 in 6 UK businesses currently selling into the US. As the UK’s biggest single trading partner outside of the EU, potential blocks to frictionless trade could not come at a worse time.

Remain vigilant

Ultimately, UK SMEs are currently working through one of the toughest periods that many of them have ever experienced.

There are a lot of questions to be considered before the end of the year. Is the recent increase in international trade a result of stockpiling ahead of anticipated issues further down the line? What do small business contingency plans look like and when will they be enacted? How can SMEs protect against uncertainty in the longer term?

Whilst WorldFirst’s latest numbers show that businesses are mucking through, the situation could rapidly deteriorate despite their best efforts and this is why effective risk management and forward planning from now is key.