By Rob Murphy, below, Managing Director, Edison Group

Given what’s going on in the economy – and the capital markets – you could be forgiven for having a somewhat negative outlook. However, less than positive news is not the full story. Nobody, other than savers, loves high interest rates. They might prop up an ailing currency but when borrowing becomes more expensive, there’s less cash available to be spent by businesses and consumers, so sapping demand. The upshot, in the short term, is slower economic growth. On average, wealth will be increasing more slowly – or even declining. So why are higher interest rates a reason to be cheerful? Fundamentally, it’s because they are one of the correct remedies for the current global economic condition. Inflation has returned with a vengeance. And despite what we had hoped for, this inflation is not transitory, it’s structural.

Given what’s going on in the economy – and the capital markets – you could be forgiven for having a somewhat negative outlook. However, less than positive news is not the full story. Nobody, other than savers, loves high interest rates. They might prop up an ailing currency but when borrowing becomes more expensive, there’s less cash available to be spent by businesses and consumers, so sapping demand. The upshot, in the short term, is slower economic growth. On average, wealth will be increasing more slowly – or even declining. So why are higher interest rates a reason to be cheerful? Fundamentally, it’s because they are one of the correct remedies for the current global economic condition. Inflation has returned with a vengeance. And despite what we had hoped for, this inflation is not transitory, it’s structural.

Inflation is bad because it makes people poorer, especially those on lower incomes who tend to spend a higher proportion of their income. Inflation became baked-in when governments and central banks created huge amounts of liquid assets during COVID-19 (think income support and quantitative easing), while production of goods and services fell dramatically. When there’s relatively more cash than things to buy, prices get pushed up. Raising interest rates makes people spend less and increases businesses costs, pulling demand back to non-inflationary levels.

So higher interest rates will fight inflation, albeit they may make us poorer. There are other reasons why higher interest rates will be good in the longer term as well. Money has been cheap since the great financial crisis of 2007–08. This has meant cash could be borrowed and used for economic activities that were profitable – but only barely – for almost 15 years.

This is harmful because low-return companies hold the economy back – they depress the rate of innovation. Doing something established and predictable might be attractive when cash is cheap. But when the price goes up and your margins disappear, the only way to deliver profits is to do something new and more productive.

Of course, not all businesses will be able to step up a gear. So higher interest rates will deliver a round of creative destruction. The zombie companies which get swept aside by higher interest rates rise will be replaced by those that are more productive.

So here is the ultimate reason to be cheerful. Not only should higher interest rates reduce inflation in the near term, but over the medium term they should also encourage innovation and productivity growth. Productivity will tend to reduce inflation in the medium term as well, as society is able to produce more goods and services per unit of resource which, as every good economist knows, is the only way to increase total wealth across the economy sustainably. Providing we get our distribution right, more people will be pulled out of poverty.

The mechanics of how higher interest rates reduce inflation aren’t entirely obvious. I like to explain it using my version of Caveman Economics.

- Our cavemen use shells as money – they trade these rare trinkets in return for food, clothes and tools.

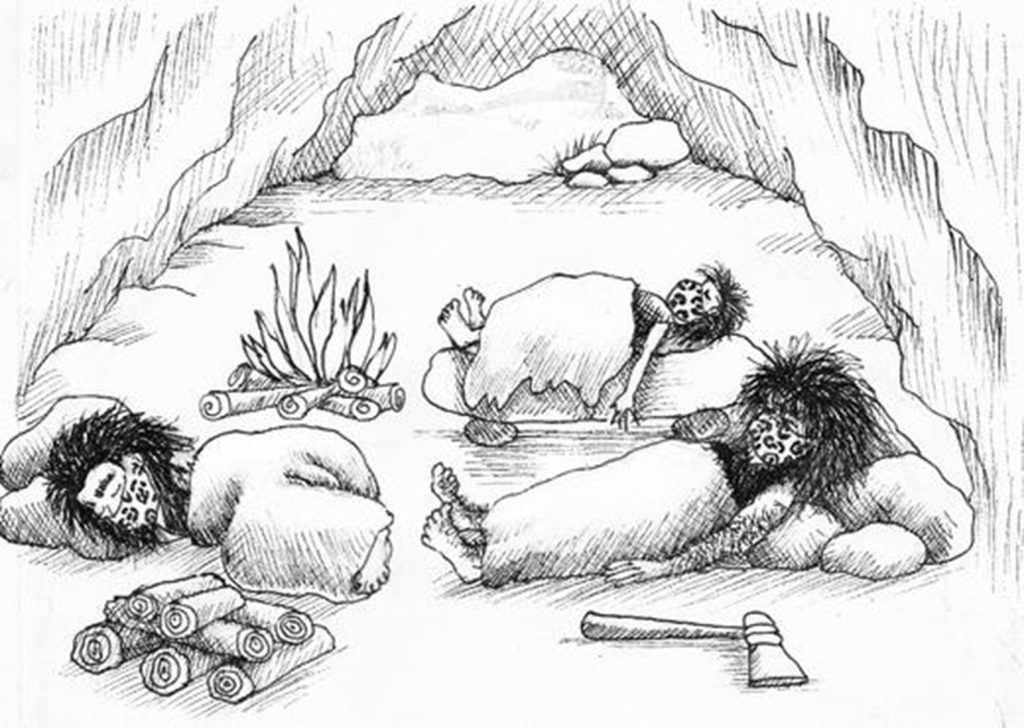

- One day the cavemen society catches an illness and many of the hunters and gatherers are unable to hunt and gather.

- Suddenly, there is a danger that people can no longer earn the shells they need to live. There is dried meat in the store and a few healthy hunters and gatherers are still able to go out, but how will people be able to pay for stuff? Luckily, the keeper of the shells is able to go to his secret bay, collect a lot more and hand them out to everyone in proportion to what they used to earn. By running down the meat stores and no longer being able to buy as many animal skins or pay the sick tribe drummers for entertainment, the group is able to feed themselves and even save some extra shells.

- Fortune shines on our tribe as the shaman consults the oracle and finds a miracle cure for the sickness using bat spit and pangolin poo gathered from a previous expedition to a land far to the east. Suddenly everyone is better and rushes to buy all the stuff they have done without – fresh meat and the latest animal skin designs. However, there’s a cost they didn’t account for. As society as a whole has been unproductive, there’s less to buy. Hunting and gathering takes time and there are bottlenecks as people wait to get the food, tools and materials they need. With demand up and supply down, prices go up as our cavemen compete by offering more shells for the things they want. With everything costing more, everyone has to charge more. Inflation has occurred.

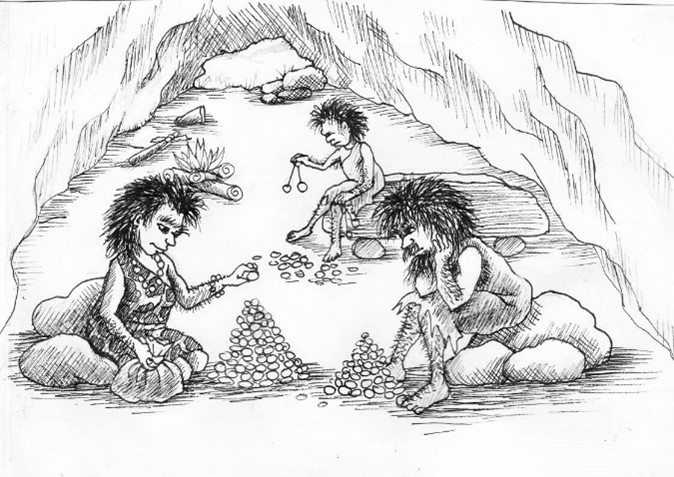

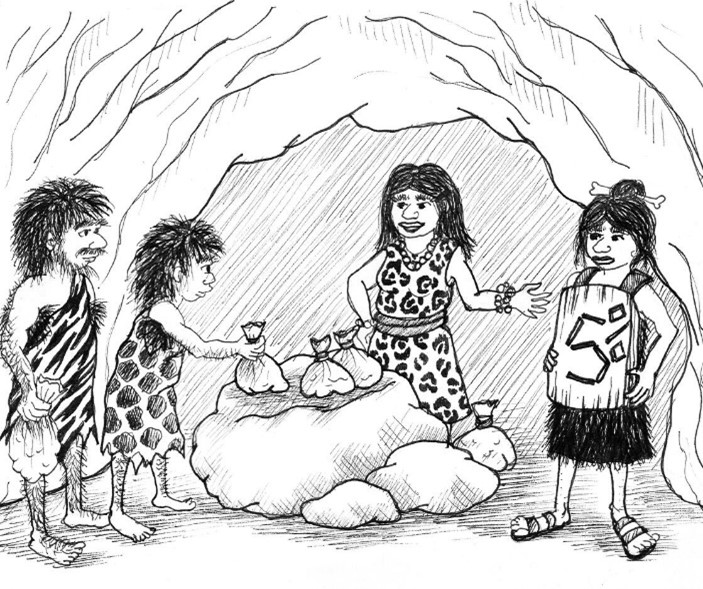

- This is unsettling. Some of the poorer people now can’t afford their fair share of the group’s output and could be going hungry. The sage caveman economist then steps in and she realises that the way to prevent inflation is to add an interest rate on shells. If the interest rate is high enough to offset inflation, then the better-off cavemen will save some shells rather than spending them, thus lowering demand.Some even lend their shells to the tribe star gazer Eland Muskrat, who creates a hunting innovation – the Hyperbow – which can kill three times more bison. He couldn’t get the shells required to make it beforehand as there was no incentive for anyone to lend them to him (after all, he is a bit weird), but now he has plenty. This innovation leads to much more successful hunting. The supply of meat goes up. The reduced demand and increased supply prevent inflation.

This story of Caveman Economics strips away the confusion over government actions during the pandemic. While fewer people were working, governments supported them without needing them to be productive. Governments funded this by borrowing – they issued government debt in the form of government bonds to be repaid many years later.

This story of Caveman Economics strips away the confusion over government actions during the pandemic. While fewer people were working, governments supported them without needing them to be productive. Governments funded this by borrowing – they issued government debt in the form of government bonds to be repaid many years later.

However, in many cases, central banks then bought the bonds, through quantitative easing. And this creates a circular flow of cash which begins and ends with the government. Governments thus borrowed for zero cost – the central banks buying the bonds will pay the interest back to the governments.

The effect was to increase the supply of money in the economy, all while there was less productive activity in a world cut off by lockdowns and the supply bottlenecks it created. This led to individuals and businesses competing for the decreased supply by offering to pay higher prices, setting off a chain reaction as more and more businesses faced higher costs. This inflation was exacerbated by central banks continuing to create more money in the belief that the inflation was transitory.

What does this show? A larger supply of money in the face of a smaller supply of products and services increases prices and can then trigger structural inflation – especially if workers begin to demand higher wages in response to an increased cost of living.

Higher interest rates are now needed to quell the rising prices. Money has to be made more expensive. As demand drops, it will equalise the supply of goods and services. Interest rates can then find a natural level consistent with lower long-term inflation.